Laptop depreciation calculator

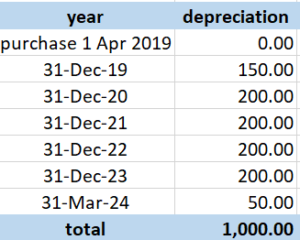

Calculate the annual depreciation Ali should book for 5 years. Where the cost is more than 300 then the depreciation.

How To Calculate Depreciation Know Your Assets Real Value

Depreciation asset cost salvage value useful life of asset.

. Determine the rate of depreciation at which the depreciation is to be charged or provision for. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers. Easiest way to do this is through excel.

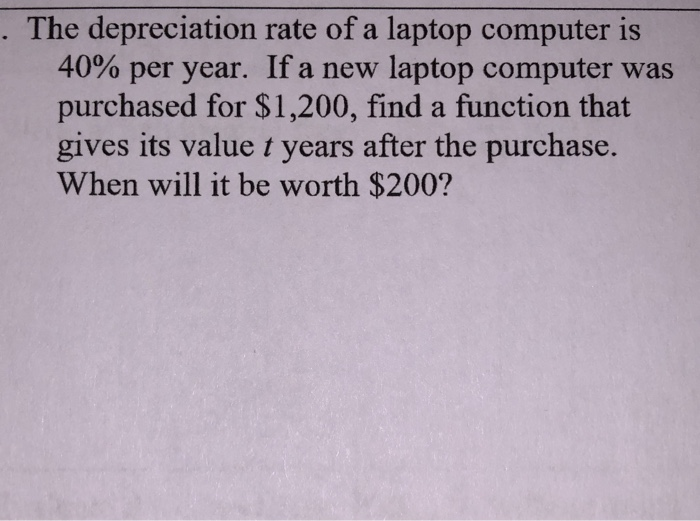

200 Declining Balance DDB. Depreciation rate finder and calculator. Find the depreciation rate for a business asset.

Mobileportable computers including laptop s tablets 2 years. You can use this tool to. Answer 1 of 2.

The computer will be depreciated at 33333 per year for 3 years 1000 3 years. The straight line calculation as the name suggests is a straight line drop in asset value. The formula to calculate annual depreciation through.

ATO Depreciation Rates 2021. The calculator should be used as a general guide only. For example if you have an asset.

Before you use this tool. First add the number of useful years together to get the denominator 1234515. Calculate depreciation for a business asset using either the diminishing value.

The basic way to calculate depreciation is to take the. All non-business taxpayers can claim a full deduction if the computer laptop or tablet costs no more than 300. Percentage Declining Balance Depreciation Calculator.

There are many variables which can affect an items life expectancy that should be taken into consideration. There are many variables which can affect an items life expectancy that should be taken into consideration. Divide the depreciation base by the laptops.

While all the effort has been made to make this. If the computer has a residual value in 3 years of 200 then depreciation would be calculated. How do I calculate depreciation on my computer.

The depreciation of an asset is spread evenly across the life. In the example 520 minus 65 equals 455. This depreciation calculator will determine the actual cash value of your Computers using a replacement value and a 4-year lifespan which equates to 004 annual depreciation.

The calculator should be used as a general guide only. The calculation methods used include. The tool includes updates to.

Straight Line Depreciation Method. There are many variables which can affect an items life expectancy that should be taken into. You can use this tool to.

ATO Depreciation Rates 2021. Then depreciate 515 of the assets cost the first year 415 the second year. This Excel worksheet will calculate standard depreciation using various methods each with its own benefits and drawbacks.

Calculate the total value of computers on which depreciation is to be calculated. The four most widely used depreciation formulaes are as listed below. He plans to sell the scrap at the end of its useful life of 5 years for 50.

When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. You can set up columns for the following Historical Value Residual Value Useful Life and Accumulated Depreciation.

How To Handle Tangible Fixed Assets Changing Tides

Macrs Depreciation Calculator With Formula Nerd Counter

Depreciation Formula Calculate Depreciation Expense

Methods Depreciation Guru

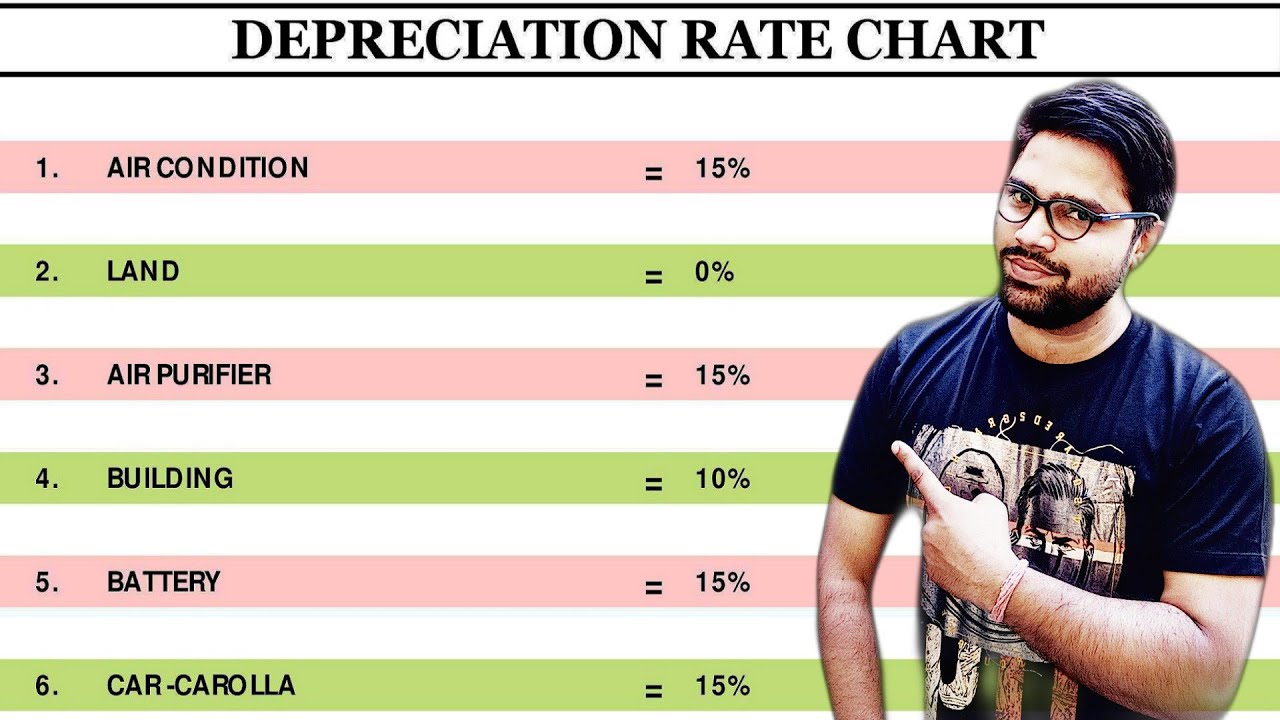

New Depreciation Rates Fy 2016 17 And 2017 18 Accounting Tally Taxation Tutorials

Declining Balance Depreciation Calculator

Capital Cost Allowance Cca For Canadian Assets Depreciation Guru

Solved The Depreciation Rate Of A Laptop Computer Is 40 Chegg Com

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

New Depreciation Rates Fy 2016 17 And 2017 18 Accounting Tally Taxation Tutorials

Working With Excel S Choose Function K2 Enterprises

Straight Line Depreciation Calculator For Determining Asset Value

Top 3 Online Depreciation Calculator To Calculate Depreciation

Method To Get Straight Line Depreciation Formula Bench Accounting

Depreciation Rate As Per Income Tax Rules Depreciation Rate Chart Dep Rate Chart Depreciation Youtube

Depreciation Rate Formula Examples How To Calculate