Retirement account payout calculator

From tax advantages maximum contribution and fees here are some details that can convince you to consider a Roth IRA. While some are overpriced and risky using the right annuity can be an effective retirement-income tool you fork over a lump sum in return for guaranteed payments for life.

10 Free Social Security Calculators To Help You Plan Retirement

Future value of savings available.

. Help me choose a Business Bank Account. A word about annuities. While the SECURE Act eliminated this stretch option in favor of the 10-year payout provision for non-spouse beneficiaries some beneficiaries could qualify for exceptions.

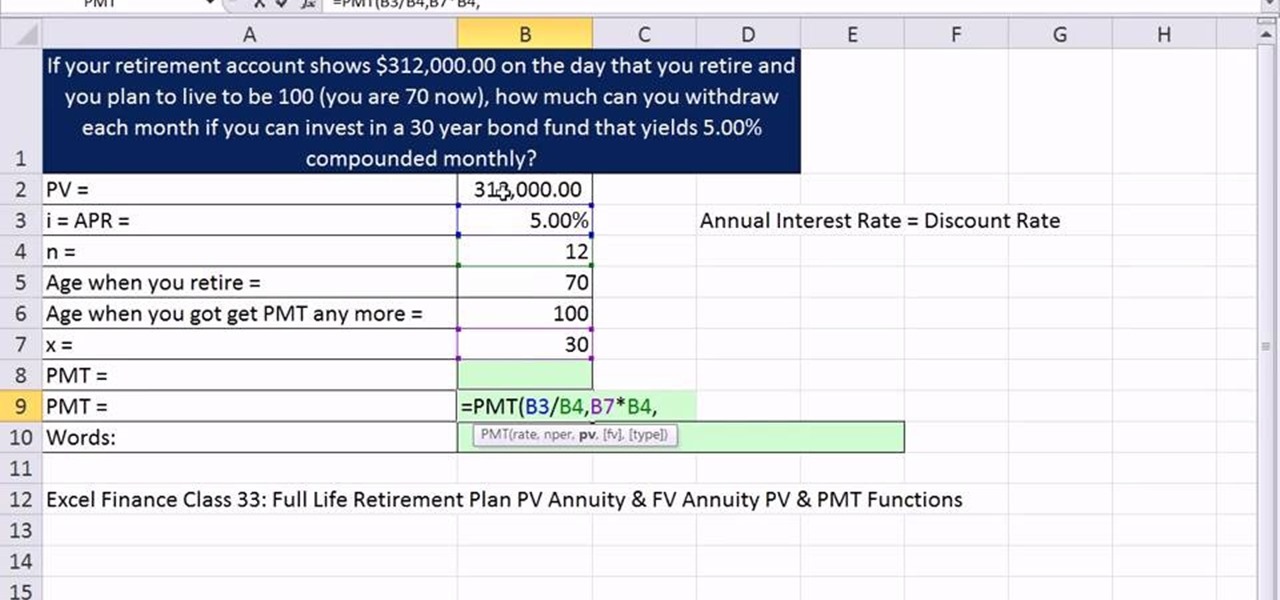

Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life. In the US the traditional IRA Individual Retirement Account and Roth IRA are also popular forms of retirement savings. 6 min read Sep 06 2022 Best places to roll over your 401k in September 2022.

Whether you have a state federal or private retirement pension start now. With my Social Security you can verify your earnings get your Social Security Statement and much more all from the comfort of your home or office. There are two methods to calculate general damages for compensation payout amounts.

Get your dividend redemption payouts directly to your bank account electronically. The account can grow without penalty due to the lack of required minimum distributions. A deferred annuity is an insurance contract that generates income for retirement.

What to bring with you. Founded in 1993 by brothers Tom and David Gardner The Motley Fool helps millions of people attain financial freedom through our website podcasts books newspaper column radio show and premium. SmartAssets retirement calculator can help you set up and plan your.

For the logic of the Endowus CPF calculator we prioritise the formation of the FRS above any subsequent retirement cash flow income. By providing the above-mentioned information the investors can calculate the retirement result which includes. Pension Benefit Payout Options.

For example an annuitant aged 60 who selects a 10-year period certain payout will be guaranteed payments until around age 70. Pension Handbooks Pension Plan Overview. If you are applying for retirement online fax the printed pages to VRS at 804-786-9718.

457 Deferred Compensation Prudential Life Insurance Retirement Goal Calculator Online Account Setup Guide Social Security. One of the most important assumptions is the assumed rate of real after inflation investment return. You can figure several retirement scenarios based on different benefit payout options and use this information in the retirement planner.

Be sure you can enter different savings account and be able to adjust your rate of return for each account. The assumptions keyed into a retirement calculator are critical. You may estimate a retirement benefit by creating your personal myVRS member online account.

On a 1 million dollar retirement account this amounts. Heres how you can stay safe and maximize your profits by becoming a home sharing host in retirement. Inheritance or life insurance payout in X number of years.

This interactive early retirement calculator will estimate your retirement age for a range of inputs. Best age to take Social Security. Check any dividend or redemption payout that you havent received.

The concept behind Roth IRA is that you make contributions to this account with after-tax moneyOnce you turn 59½ and have been in a Roth IRA plan for five years all distributions taken from the plan are tax-free. You can opt to enter either a lump sum pension payout OR monthly payments. Retirement Calculator Plan early to keep up with your lifestyle even after retirement.

MyVRS is a secure online system that uses information from your VRS record to calculate a retirement estimate for you. The annuity calculator helps to compute the income from investment in a specific period. Lump Sum Payout Calculator.

This method takes into account your special damages and then multiplies them by a number between 1 5. Enter your account balance-Your interest rate. 2 your remaining CPF savings after you have set aside your FRS in your Retirement Account.

The first is the Multiple Method. Required Minimum Distribution RMD Use this calculator to determine your Required Minimum Distributions RMD as an account owner of a retirement account. IRA and Roth IRA.

Please visit our 401K Calculator for more information about 401ks. A fixed-length payout option also known as fixed-period or period certain payout allows annuitants to select a specific time period over which the annuity payments are guaranteed to last. Have a Financial Planner contact me.

And adjusted for inflation. Wyoming Retirement System 457 Deferred Compensation Plan information. Results of Annuity Calculator.

In exchange for one-time or recurring deposits held for at least a year an annuity company provides incremental. 1 to 100. The more significant your injuries the higher multiplier you will want to use.

Otherwise include the printout from step 4 with your paper retirement application and mail to VRS. Print this page by selecting PrintSave a Copy of your Estimates and include with your retirement application if you are electing the Advance Pension Option. A QDRO protects you and it also ensures that a marital settlement does not allow the funds in the retirement plan to be withdrawn without penalty and then deposited into the non-employee spouses retirement account typically an IRADont assume that your rights to retirement assets are covered just because your divorce decree states that you have a right to.

How to avoid early withdrawals. Retirement calculators vary in the extent to which they take taxes social security pensions and other sources of retirement income and expenditures into account. Only distributions are taxed as ordinary income in retirement during which retirees most likely fall within a lower tax bracket.

We have a variety of calculators to help you plan for the future or to assist you with your needs now. See these tips for finding and using a retirement calculator with pension. The FRS can be set aside by up to 50 the CPF Basic Retirement Sum with your property value.

Inherited IRA rules. The best way to start planning for your future is by creating a my Social Security account online. Best and worst states for retirement.

Additional savings that is required. The ability to introduce and calculate for a future lump sum distribution eg.

Net Worth Calculator Find Your Net Worth Nerdwallet

How To Calculate Monthly Retirement Income In Microsoft Excel Microsoft Office Wonderhowto

401k Calculator

Estimate Your Benefits Arizona State Retirement System

Free 401k Calculator For Excel Calculate Your 401k Savings

The Best Annuity Calculator 17 Retirement Planning Tools

Download 401k Calculator Excel Template Exceldatapro

Free 6 Sample Retirement Withdrawal Calculator Templates In Excel

Free 6 Sample Retirement Withdrawal Calculator Templates In Excel

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Fire Calculator When Can I Retire Early Engaging Data

Retirement Withdrawal Calculator For Excel

Customizable 401k Calculator And Retirement Analysis Template

Download 401k Calculator Excel Template Exceldatapro

403b Calculator

Retirement Savings Calculator

When Can I Retire This Formula Will Help You Know Sofi